Business transition planning can often be complicated by family dynamics that present unique challenges. As wealth advisors in a family office, we work hard to serve the entire family with the overarching goal of keeping the legacy intact. Understanding conflict, hesitations, and hurdles in the planning process is critical to delivering a plan designed to work and benefit the big-picture vision of the client.

Assumptions and Conflict in Family Wealth Planning

Getting ahead of the curve and hashing out every detail is the best way to resolve conflict before it begins. Making assumptions about how a transition will happen is a surefire way to create chaos and conflict when the time comes for a transition. There are simply too many moving parts and unanswered questions.

Planning for a transition removes the assumptions and qualifies every action that will take place throughout the transition.

The process begins with a few big questions:

- How do you envision the future of the business?

- Who will assume specific responsibilities?

- What is your big-picture vision for the business as part of your legacy?

After working through the big vision, we can work through all the logistical options, determining the best course of action for a business transition. With each detail accounted for in a plan, there is little room for conflict and a clear path toward success.

If nothing is in place when the head of the family passes away, underlying assumptions and beliefs can create complicated situations and real disharmony between family members, quickly tearing apart a family legacy.

Keep your legacy intact with a detailed plan.

Procrastination Puts Your Legacy at Risk

Often clients will procrastinate because they are busy running a company and simply don’t have the time or capacity. Difficult questions are presented and even harder decisions are made regarding heirs, future business leadership, and how everything will be accounted for after the transition.

It’s natural to avoid these conversations but waiting increases the risk of conflict and issues arising because a plan is not in place. Family stakeholders will absorb the lion’s share of responsibilities and it pays to stop procrastinating and prepare them for the future.

In that sense, difficult conversations can lead to productive and positive outcomes for everyone involved.

Tackling Obstacles as a Team

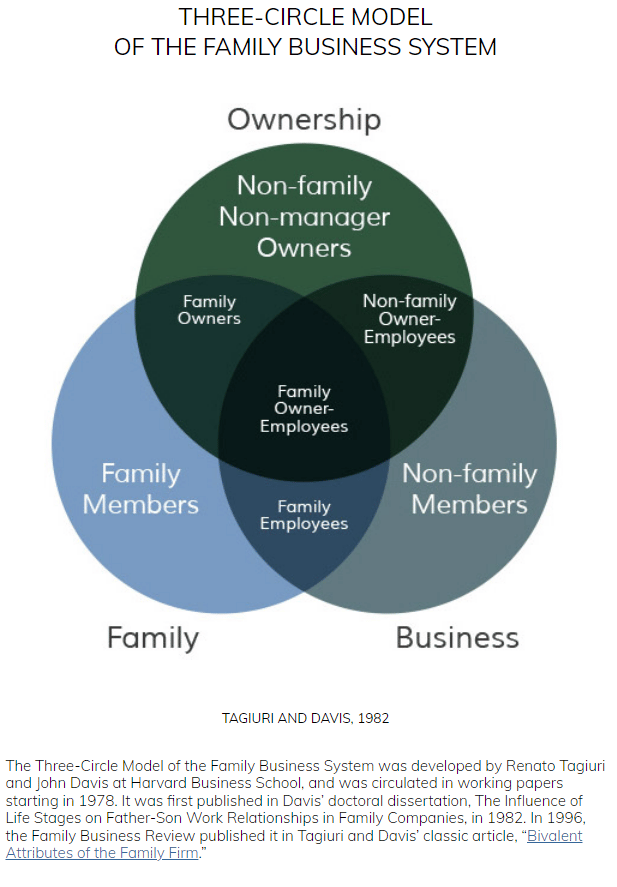

This framework clarifies, in simple terms, the three interdependent and overlapping groups that comprise the family business system: family, business and ownership. As a result of this overlap, there are seven interest groups present, each with its own legitimate perspectives, goals and dynamics. The long-term success of family business systems depends on the functioning and mutual support of each of these groups.”

– John A. Davis, Creator of the Three-Circle Model

Business transfers are exciting and fulfilling but also very challenging. Many business owners are faced with obstacles during the transition that have nothing to do with the operation or ownership of their business. The potential to open old wounds or broach difficult and emotional subjects can cause significant stress.

In addition, asking for help to facilitate those conversations can be equally stressful as most family matters are kept private. The Three-Circle Model is a useful tool for sharing responsibility in the process while also maintaining control and independence.

This model represents the three interdependent and overlapping systems in a family enterprise. Success hinges on each system supporting the others.

One way that you can avoid common missteps in business transitions is by making a commitment within your wealth plan to put time and energy into understanding your family’s unique framework and the overlapping groups that create family dynamics affecting your overall plan.

How Can Family Business Transition Planning Benefit from Dedicated Advisors?

Combining family and money creates very personal and sensitive situations. Utilizing a mediator to help guide you through the decision-making process and focus on abundance and sympathy for optimal long-term interest can ensure the best possible decisions are made for everyone.

The third party is beneficial because those deep-rooted emotions are removed and they can present options objectively while still being considerate of the relationship dynamics. Family business consulting can resolve conflict and give the family heads the opportunity to take control of their legacy, while protecting and guiding a better future for their heirs.

The interdisciplinary focus of family business consulting includes areas like: accounting, finance, law, family therapy, behavioral/management science, and family governance. It is critical to focus on these areas while you review potential paths for transition. The wide range of disciplines applied also lends itself well to a holistic approach focused on the best pathways forward given the individual circumstances and desires.

When completing a family planning exercise with Private Wealth, you will receive tangible tools to create a stronger family bond and develop communication that focuses on the overarching vision of the family.

Tools we Leverage in Family Business Consulting Include:

- Family Constitution

- Family Governance Plan

- Financial Literacy Program

- Career Development and Coaching

- Family Retreats

- Genograms

- Strategic Planning Meetings with the Family

Leveraging Family Business Consulting will help you to have a plan in place that addresses individual needs and a level of understanding that moves the family toward a path for successful transitions and long-lasting legacy.

At Private Wealth, we are dedicated to business transition planning, generational family planning, and asset management. Get in touch to schedule a consultation about your business transition and the future of your family wealth.