‘Tis the season for the investment world to release their prognostications for the year to come and, like you, I am busy reading all of them!

I find it entertaining to see how all strategists seem to start with essentially the same conclusion and then work hard to validate their forecast with a detailed description about how the process they use is very rigorous. The image that comes to my mind is the “Family Circus” comics I read in the local Sunday paper while growing up. The forecasters all start from today and up with very similar projections for the end of next year, but they all take their own proprietary path to get there! I tease them about it when I get the chance… my first question to strategists from Wall Street is “When was the last time you forecasted a negative return for the following year?”

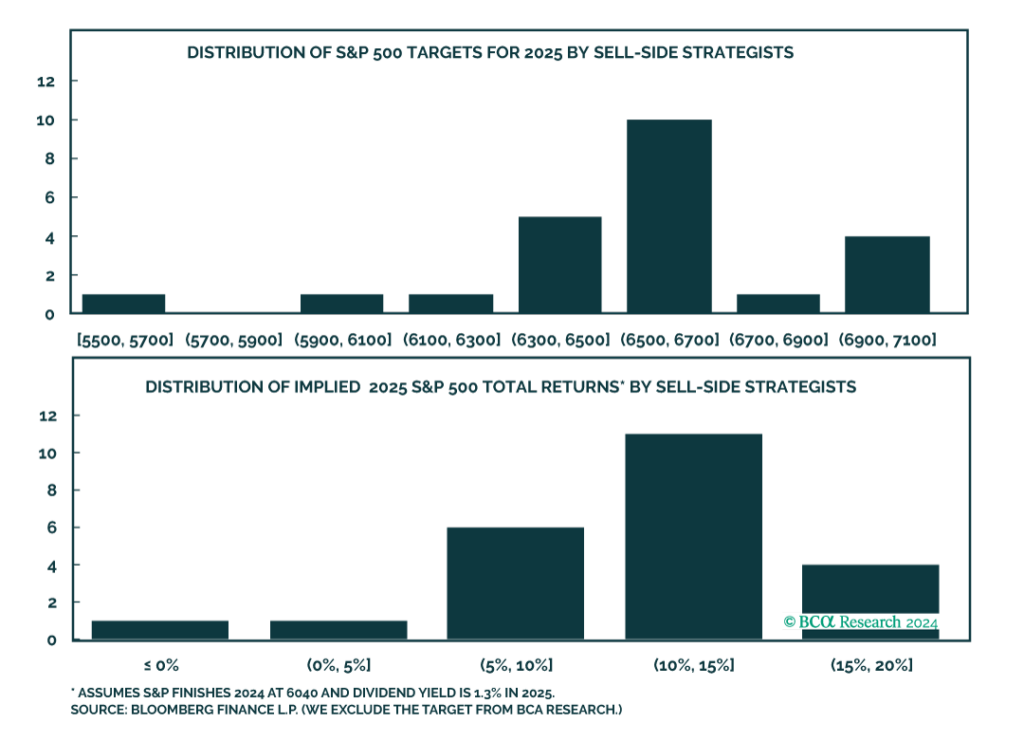

The average annual return for the S&P 500 since 1926 is roughly 10%… and, to the surprise of nobody, the “average” expected return across Wall Street for next year (and for every year) is not significantly different. One thing our team reinforces with clients is that the “average” expected rate of return rarely happens. For example, the expected return for the S&P 500 in 2024 was for an increase to a range of 5,100-5,200… the forecast missed by 15% as the index is currently above 6,000. It is a very tough game to put predictions out for public consumption and there is little incentive to stray too far from the herd.

The chart below was prepared by BCA Research; it provides a great picture of where we are today with S&P targets for 2025 (the average target is around 10%)

How does the team at Private Wealth Asset Management view the markets next year? I refer you back to the Family Circus comic above; we know there are no shortcuts. We will walk with clients down the sidewalk like Billy’s grandmother and we will arrive at the end of 2025. The future for financial markets (2025 and beyond) will be more like Billy’s dotted line path, creating both opportunities and risks. When cashflow, taxes, risk, and investments are coordinated, a few things happen:

- the need to know what the markets will do tomorrow becomes less relevant

- the walk through the park becomes easier

- You can read all the market predictions for their entertainment and educational value

See you in 2025!